Almost anywhere you go, when you start a business, you either do so as a company or an individual. To keep things from getting too confusing, this post is going to be specifically for freelance expats who make an income on their own, in Germany.

Okay, let’s do this.

While most money-making (i.e. non-student) expats come to Germany with a German-based company, a growing number work for themselves, whether they’re starting their own business or offering freelance services.

Paying taxes in Germany can be a convoluted process, even more so when you work for yourself. Unlike full-time employees at German companies, self-employed people need to form a special relationship with the Finanzamt to register their business and pay monthly VAT.

Don’t worry, let’s figure it out together.

In all my years as an accountant, I’ve worked with many freelance expats, and here are the most common questions I get asked every day.

Hey, freelance expats, here’s your ultimate tax guide!

Do self-employed expats need to pay German taxes?

Yes. The second you have an address in Germany and make money while living here, you are required to pay Germany taxes. This includes freelancers with international clients, even if you make money in another currency.

Germany has three important tax categories:

- Income tax (Einkommensteuer)

- Trade tax (Gewerbesteuer)

- VAT (value-added tax, Umsatzsteuer)

While each person and business is unique, these three categories are relevant for most people doing business in Germany.

If you sell products (i.e. have a retail store or own a cafe) you will need to pay trade tax. There are a few different tax restrictions, which we won’t go into here, but know you will be treated differently in this case.

How much do I need to earn before I’m required to pay taxes?

This number changes every year. In 2016 you could make up to €8,652 in a single year before you’d have to pay income tax on that income.

Technically you should still register as a business and submit a return at the end of the year, even if you stay under this amount.

For people who sell goods—not services—and are required to pay trade tax, the tax-free amount for trade tax is €24,500.

How much money should I put away to save for income tax?

My advice is to set aside around one-third of your income. So if you invoice a client €150, put €50 in a separate account just for income taxes.

Obviously, this depends on how much money you earn. Like anywhere, the more profit you have, the higher the tax rate. If you make between €30,000 and €80,000 per year, then you should be fine taking 30% out of every invoice to pay for income tax.

What is the first thing an expat freelancer should do upon moving to Germany?

Register with the Finanzamt and tell them that you will be working for yourself. Registration is free and relatively painless.

The Finanzamt is Germany’s version of the IRS, but there are locations in every city and you must register with them because….

- They will send you a new tax number (Steuernummer)

- You will have to pay VAT each month to the Finanzamt using your tax number

- You may have to pay prepayments for income tax

If you have any questions, find your closest location and go inside. Each Finanzamt has a service for people who are starting a new business and you can ask them to point you in the right direction. The staff is very helpful and you don’t need to make an appointment.

You will be required to fill out a form, called the “Fragebogen zur steuerlichen Erfassung” (Formular-ID 034250).

You will be asked for things like:

- Name, address, etc

- Business description

- Bank information

- Last year’s income + estimate for the upcoming year

- Information for your spouse, if applicable

- If your services require VAT payments (more on this below)

- Employee information, if applicable (if you hire people for your business, you will have to pay social security for those employees)

The application is around eight pages long and will need to be completed in German. I recommend partnering with a tax advisor or German-speaking friend to complete the form if you do not speak the language.

The Fragebogen zur steuerlichen Erfassung form can be found on Google by typing in “Fragebogen zur steuerlichen Erfassung“. It is the first link that will appear. The form is valid for 45 minutes which is why we are unable to include the link into this post.

Once complete, mail the form to your city’s Finanzamt location.

In around 4-6 weeks you will get a letter from the Finanzamt with your tax number (Steuernummer).

This number is important because it has to be on all your German invoices to German clients. Once you have your tax number, you can apply for your VAT tax number (called your VAT-ID, Umsatzsteuer-Identifikationsnummer). The VAT-ID is needed if you do business within the European Union.

What is VAT?

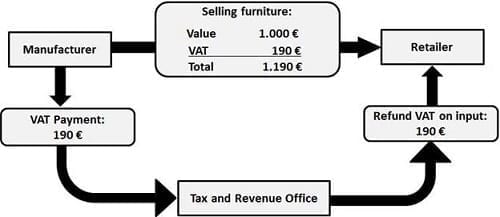

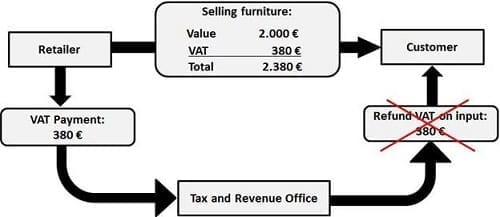

VAT is a tax you have to pay when delivering a service or good. It is paid by companies but will be reimbursed from the Finanzamt. For private people, VAT will not be reimbursed.

In Germany, there are different words for VAT: Umsatzsteuer, Mehrwertsteuer, Vorsteuer. These terms, more or less, all mean the same thing.

Here’s a handy graphic to help you understand the VAT payment process:

Generally, VAT is 19% (though in a few cases VAT can be 7% or 0%)

Let’s explain with an example…

Imagine you designed a brochure for Sabine and charged her €150. You would invoice Sabine €150 with an additional 19% VAT. That comes to €178.50 in total.

Sabine pays you €178,50. You, as a freelancer, will then tell the Finanzamt that you received €178.50 and will pay them €28,50 of that amount. At the end of each month, any VAT you collect with be transferred from your bank account to the German state.

Because Sabine is also a businessperson, she will then claim that €28.50 back from the Finanzamt.

However, if she weren’t a businesswoman and instead just wanted a brochure designed for personal reasons, she could not claim back that €28.50. Either way though, you have to invoice her for it.

It’s a weird roundabout money flow. At the very least, try to understand the general system and make sure you collect that 19% from any client you invoice.

The basic idea is that the VAT is paid not by business people, but by private people.

If you invoice clients outside of Germany, but still in the EU (i.e. The Netherlands, France), you generally don’t need to include VAT in your invoices. However, if you invoice clients in the United States, you don’t need to charge VAT at all. Instead of VAT there should be some additional information on the invoice. But if you work with German clients you have to include that 7% or 19% on all invoices.

How and when do I pay VAT?

Each month you will transfer any VAT to the Finanzamt. You have to do this online. All VAT has to be reported 10 days after the month ends. So by the 10th of September, you have to report your VAT and pay online for the month of August. The Finanzamt will just take that money from your bank account.

Do you have any other questions not addressed here? Email daniel.schmaltz@schmaltz-partner.de.

If you’re in need of some more tax tips, check out our posts on the easiest way to file your VAT tax as a freelancer, how to get a tax ID number, what expenses you can deduct as an employee, and more!